Dear Partner,

It is with great pleasure to inform you of Centevo’s recent news.

Centevo is now part of the Profile Group, an international financial solutions provider with presence in 45 countries and more than 30 years of experience. We are confident that the range of solutions complements each other and will deliver you with more options on various functions.

Centevo’s solutions have continuously been enhanced to offer a more attractive approach to our clients.

Our enhanced offering of “Centevo Suite” includes:

- Asset Management

- Fund Management

- Portfolio Management

- Family Office

- Trust Management

The End-Client solution – available to use with any of the above solutions –

has been improved and new functionality has been added in the Integration Services package.

The BPO services are continuously being enriched to deliver best available service to its users.

We hope you enjoy reading!

The Centevo Team.

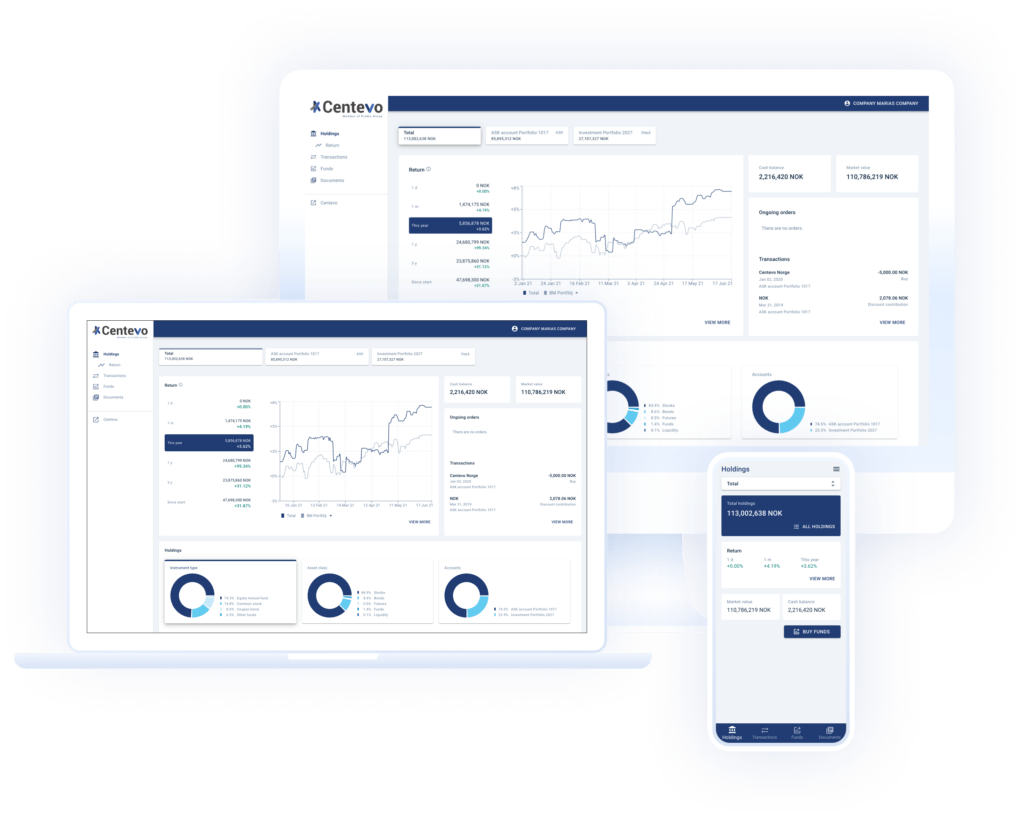

1. Upgraded Solution

The Centevo End Client solution is continuously being developed to deliver a powerful web-based application that offers a clear overview of end clients investments. It is a secure channel to send and receive encrypted communication and a straightforward platform for fund trading. End customers benefit from a range of new characteristics, including e.g. Position Overview (Holding Overview), comparative reporting and fund trading platform.

What do you gain?

- Easy to use interface for end clients

- Secure client communication

- Signing of documents using BankID

Additional features:

- New client onboarding

- Automated client onboarding & account opening functionality (including collection, verification of KYC data & documentation)

2. Buy-side trading integration via FIX

Centevo’s Cairo platform now offers the option to place orders to the exchanges via your

brokers using the standardized FIX protocol. Integrations with broker networks are available such as Bloomberg or directly to a broker providing FIX connectivity.

The additional functionality means that orders for stocks and ETFs can be initiated directly in the system eliminating manual steps whilst increasing STP automation. Furthermore, fills received automatically with the trade time and executing venue which can be integrated with transaction cost analysis systems such as Bloomberg BTCA to meet MiFID II requirements for Best Execution.

Once the order is created in Cairo, pre-trade compliance checks are carried out and the order is automatically sent to the exchange via your broker or staged in an EMS terminal depending on the setup. The order turns to a transaction incorporating commission fees. Once the order is completed, canceled, expired or marked done-for-day and after, settlement instructions are forwarded to the deputy bank.

What do you gain?

- Automatic creation of transaction on closure

- Pre-trade checks safeguard you from ending up short

- Compliance control

Reviewing a challenging although rewarding in some respect year and looking forward to a more promising year ahead, Centevo being part of a larger organization can easily support you with a range of other solutions for your needs ranging from digital banking, core banking, lending, risk and treasury management.